|

By Graham K. Rogers

It has been an odd couple of days in Apple-land, with the announcement of An Event in San Francisco on 7 September and a ruling by the EU that Apple must pay taxes to Ireland that the government say they don't want. This has all been peppered with the usual rumours and a touch of doom.

Just after I put out a Monday comment earlier this week, Apple sent out one of its mysterious emails to journalists in the USA. There was a blurred photograph and the sentence, "See you on the 7th.", both of which have been parsed beyond all possible meaning. I mean, two identical white bokeh lights near the center of the image are seen by some as confirmation that the new iPhone will have two cameras.

I checked my email several times the next day, but it is not my turn. I will watch on Appletv and read the comments of the more sensible writers as well as the technical specifications, before coming to any judgements.

A couple of additions to the collection of rumours appeared, including one that suggested that the boxes for the iPhones (these have been spotted somewhere, we are told) contain an adapter for headphones. If so, and if Apple is changing the connection method for audio output (I hope they do), this is a sensible move and will put paid to all those angst-filled posts, many of which would be expected to have the theme, "I will never buy an Apple product again". These are of course frequently written by those who have never owned any Apple product before anyway.

The ruling by Margrethe Vestager of the EU Competition Commission brought out as many headlines about Apple, with as many different points of view as I have seen on anything in recent years that involves Apple. The Commission decreed that Apple must pay back $14.5 billion in under-paid taxes to the Dublin government as the sweetheart deal that was set up several years before put other EU states at a disadvantage. With the number of similar investigations going on, maybe the member states want to run their own shows.

This sort of rate-sweetening is common in the USA, whee politicians go out of their way to provide concessions for companies, so that they will set up in their state and hope this leads to economic benefits, including jobs. Of course, it doesn't always work like that, but the legality in the USA is not in question.

One of the problems is that the EU wants total conformity and the member states want the freedom to set their own tax levels, having lost most sovereignty to Brussels and its bureaucrats. As Apple has always said, when dealing with grand-standing politicians in the USA who hate the idea that there is money sitting about that they cannot get their hands on, the company pays all the taxes that are due. Remember that it is the politicians that write the laws, but they are the first to cry foul if a company uses those laws to lessen their taxes.

Some of the comments in this case are worth looking at:

- Writing on Seeking Alpha, Yoel Minkoff provides a basic summary of the decision, particularly the point that Commissioner Margrethe Vestager claims that, by the selective treatment, Apple was able to reduce its corporate tax bill down to 0.005% in 2014, a figure that Time Cook vehemently denies.

- On Engadget, an analysis by Matt Brian reports the Commission findings that the "agreement that it had signed with Ireland was illegal": giving tax benefits to selected companies is illegal under EU state aid rules. There is a useful diagram of cash-flow with this article and an additional comment (among many) that "The US won't agree with the ruling, given that it feels that any tax Apple owes should go to the treasury" - the US Treasury. And remember under current rules, if Apple repatriates the cash it holds abroad, it will be levied 30%: something no CEO or CFO would sanction.

- Time Cook has not been silent on this and posted an open letter on Apple's site to the Apple Community in Europe. In this he outlines some of the history of the Apple deal with the first premises in Cork dating from 1980, when the Irish economy was not good. In the letter, Cook writes that the EU claim that Ireland gave Apple a special deal on taxes "has no basis in fact or in law". Both Apple and Ireland will appeal the ruling. In interviews with several newspapers, Cook has been sounding quite belligerent.

- It is unusual for a government to turn down extra money, especially such an amount; and some people in Ireland have already protested this stance, suggesting that the country could do much with that sum, particularly with infrastructure and with hospitals.

- There is also the government's own annoyance with the interference in its sovereign affairs by Brussels, once again. Not so long ago, the people of the UK voted (many in error it seems now) for the country to leave the EU and that process is being worked on now. It seems that if Ireland is also suitably unimpressed by the EU, an attempt at its own exit could see the eventual dissolution of the EU, as other countries would be sure to consider this as well.

- To my surprise, despite the decision that could potentially remove $14.5 billion from Apple's savings, the share price has remained fairly stable this week.

- As well as Cook, CFO Luca Maestri weighed in and in an article in the Irish Times by Joe Brennan there was concern that after the ruling, multinationals would have concerns in the future about investing in Europe, suggesting that the ruling was a shoot yourself in the foot decision. However, Maestri confirmed that Apple's plans to invest in Ireland had not changed. The article also has some background on Ireland and the worries that some politicians have: credibility. [My source for this was MacDaily News]

- Over at 9to5 Mac, Ben Lovejoy was not wholly convinced by the stance that Apple is taking, calling it "tone deaf". He thinks that of the arguments in Cook's letter, only one is relevant. However, on the question of paying taxes that were due, he suggests that this is the fault of the Irish government: they told Apple how much, Apple paid, but the taxes were too low.

He also makes a point that I have discussed before (and above), "Company directors have a legal duty to maximize the return to shareholders. If a legal tax loophole exists, the company has to use it." The article has another useful money-flow diagram, but I cannot agree with the irresponsible suggestion he closes with, even though it is clothed in the brand image argument, "It might be smarter in the long-term to take the hit now."

- A fairly good analysis is available on Business Insider with Dan Bobkoff looking at some of the technical tax points involved. He takes no specific view for or against Apple, Ireland or for the EU; but he also includes the reasons for the US government's opposition to the decision, which could also affect other US companies (such as Amazon).

- On an Austrian economics site Jeff Deist, takes a very different view and rails against Apple and Cook for their gross hypocrisy on taxes, pointing out the hatred politicians have for any attempt at liability reduction. I am not entirely clear on Deist's argument: the dense style and switching between who should be blamed, was a bit confusing, but he seems to argue that Cook's liberal stances make him wrong for trying to manage Apple for the stockholders.

His distinction between the company that pays what it owes or what it ought to owe, or an amount needed to sustain a robust safety net, is fallacious and Cook's personal politics do not get in the way of his stewardship of the company. However, Deist's outlining of the US "worldwide tax system" is worth taking in as I see many here who are upset by the way Uncle Sam never stops chasing. As a UK citizen, what I earn in the UK is taxed there; what I earn in Thailand is taxed here.

- Another commentator on Seeking Alpha, Mark Hibben, calls the tax bill, "The European Union's Pointless Tax Crusade". He takes many of the points that Dan Bobkoff makes, but there is an interesting observation in that the decision is "a departure from previous interpretations and legal decisions by the European Court of Justice (ECJ)", which may mean several years of courtroom dramas, although he looks forward to a quick resolution that wil please everyone (except perhaps the EU).

- Another interesting viewpoint came in a Reuters report carried by Fortune. Some similar points as above were raised, but also the "case to answer on charges of anti-American activity". Margrethe Vestager denies that this is the situation, but almost all of the cases that she has dealt with involve US companies. It may be this that has the US Treasury so annoyed. The Reuters article suggests that for her next fight, she may want to "choose a company closer to home."

The article also points out that most of the evidence for the Apple case was provided "by a U.S. Senate subcommittee inquiry into taxation." That would be the grandstanding senators Levine and McCain I guess, whose patronisation and hypocrisy when questioning Time Cook a couple of years back were quite sickening.

On Tuesday there were also strong rumours about new Macs in the pipeline. These are not really unexpected: the only questions are when and what? A report from Bloomberg, covered by Eric McCaffrey, on Seeking Alpha suggests iMacs, MacBook Pros (sic), MacBook Airs (sic) and a 5K monitor. The MacBook Pro is a must: without an update to that, Apple would be leaving some of its most loyal customers behind. The problem has apparently been the processor from Intel who had apparently been a little slow with its latest chips. The iMac is also in need of a speed update, although those with a 5K monitor have a lot of life in them as yet.

New Macs Coming (Image of MacBook computers courtesy of Apple)

If true, I am surprised that the MacBook Air is to be updated, but why not: Apple has a wide range of notebooks and tablet devices so that they can pitch a product for anyone's needs.

The 5k monitor - a collaboration with LG Electronics - also if true, would be a sensible product decision after the end of life of the previous Cinema Display a few months ago and would send a message to professional users that Apple recognises their needs too. Which leaves the Mac mini and the Mac Pro. I would expect the Mac mini to be in line for an update; but there has been precious little about the Mac Pro in the rumours.

Jason Snell on 6 Colors also commented on these rumours, but wondered about the date: if not 7 September, then when? was his theme, commenting on a rumour via Mark Gurman whose track record is pretty good. He does not think there will be Macs at the event. I had never expected them at the iPhone event: it detracts too much from the main theme. Snell's article runs through some of the options, including a small town-hall event. Whatever the decision by Apple, the publicity will follow.

We might also look at the detective work done by Benjamin Mayo on patent filings (although I usually rely on Jack Purcher at Patently Apple). Mayo suggests that documents from Russia indicate an iPhone 7 resembling an iPhone 6s with dual cameras. There are also "versions of Apple Watch 2 and maybe tweaked Apple Watch 1 hardware too". Further down there is a mention of "a trademark for 'AirPods'" which seems to link again to the rumours concerning the loss of the 3.5mm audio jack; or at least what might replace it. In the box, or an extra?

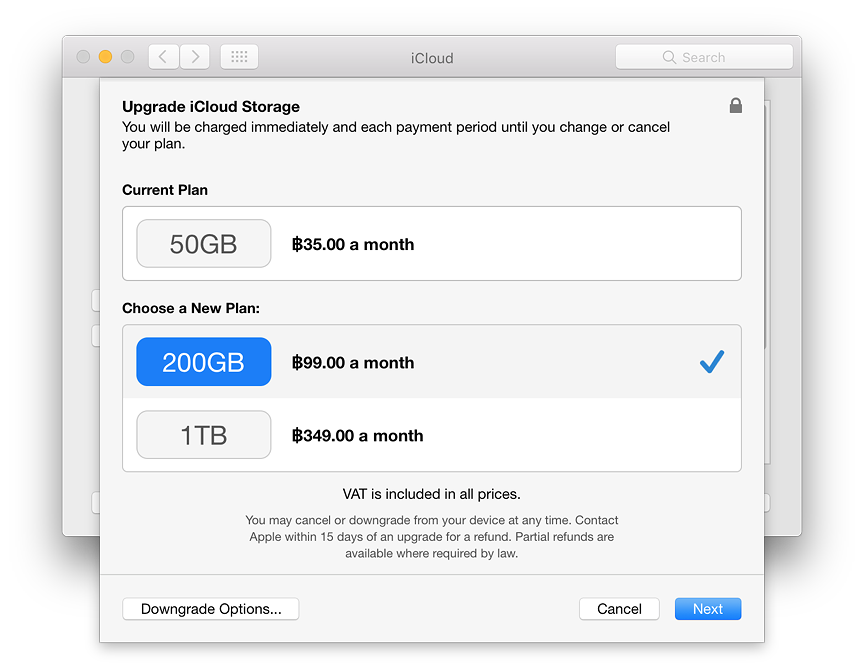

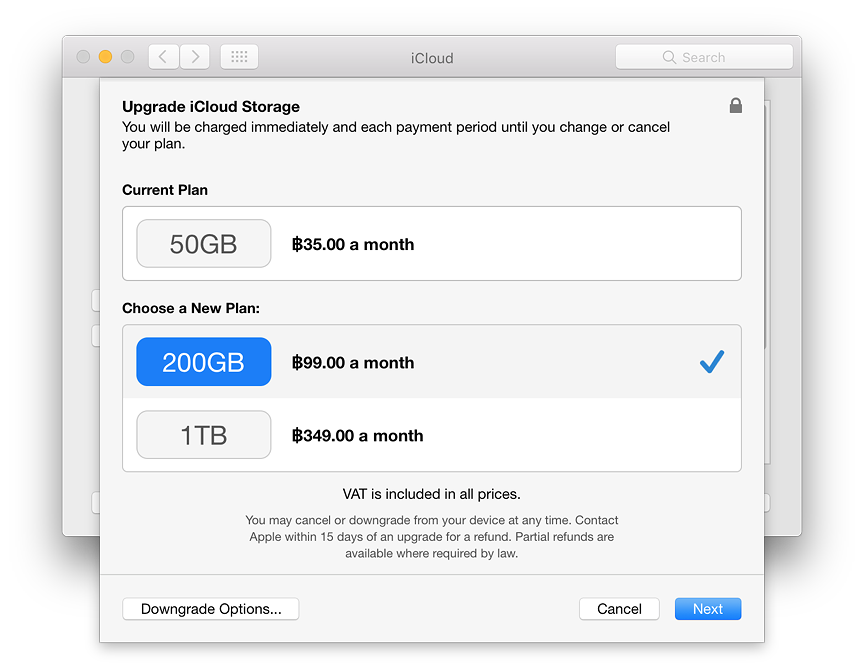

A week or so ago, I commented on the way my iCloud space was evaporating. So much so that in about 6 months, I went from a legacy 25GB to 50GB storage and last month to 200 GB. Next on the list was 1TB ($9.99/month) although I did not expect to be hitting that for a while. This week, Jeff Benjamin on 9to5 Mac (and others) comment that Apple has now increased the maximum space available from 1TB to 2TB at a new price of ($19.99/month). As I said last month, this is one of Apple's little income secrets and services are going to become an increasingly important part of the balance sheet.

I have commented before about the way Apple's industrial processes will keep adding value to the company, not only because they own patents for such processes that others may want to use, but because of the way the factory operations are made so much more efficient. Writing on Patently Apple, Jack Purcher also comments on the attention to detail behind the scenes that have been highlighted by a Tech.pinions article.

I sometimes wonder why great companies make the decisions they do. Not Apple, but Hasselblad. I love the older film camera I have and enjoyed my brief look at the H6D a massive digital version for some $33,000; and I would seriously love to buy their new mirrorless camera which uses the same 50MP CMOS sensor as one of the digital monsters. I thought that the company was on a roll this year, until this week, when its 4116 Collection was announced.

They have produced a X10 optical zoom device that clips over a smartphone, secured by magnets, and takes RAW images. "It offers a physical shutter, Xenon flash and zoom, making it easy to capture incredibly detailed images in any environment."

But the phone that Hasselblad chose to take this massive step into the mobile market was the Moto Z smartphone range: Motorola for heaven's sake. I could almost have forgiven them if the Galaxy 7 had been the device of choice, although they are off the market for now while Samsung investigates battery fires.

What were the gnomes of Göteborg thinking?

Graham K. Rogers teaches at the Faculty of Engineering, Mahidol University in Thailand. He wrote in the Bangkok Post, Database supplement on IT subjects. For the last seven years of Database he wrote a column on Apple and Macs. He is now continuing that in the Bangkok Post supplement, Life. He can be followed on Twitter (@extensions_th)

|

|