Cassandra: Mid-week Comment - Apple Q2 2015, Apple Watch, Detractors, Donations and More

AMITIAE - Tuesday 28 April 2015

|

Cassandra: Mid-week Comment - Apple Q2 2015, Apple Watch, Detractors, Donations and More |

|

|

|

By Graham K. Rogers

I think many people had been expecting that the iPhone - the driver of Apple these days - would maintain high sales, but many were looking at around 57 million although some analysts had gone as high as 70 million. The final figure of 61 million in a quarter that has traditionally been lower than the end of year, shows just how markets are shifting. While the United States is still Apple's home market, Asia is predominant, with China in the driver's seat. That figure was almost-certainly helped by the Chinese New Year when red envelopes full of cash are traditionally handed out. You have cash, you spend. Some commentators are really going to have trouble getting their heads round these numbers as some had confidently predicted a fall off after the new year. Try thinking in World terms rather than just the traditional Western markets.

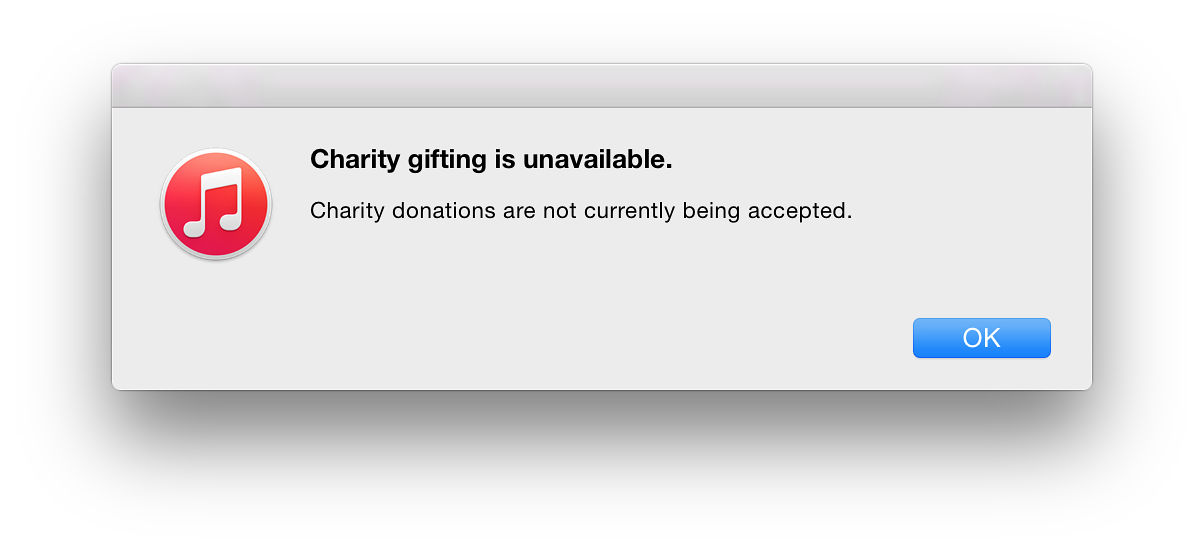

Ming-Chi Kuo makes the headlines far too often and is more often wrong (as here), yet some writers hang on his every word in their philosophy that appears to hinge on only ever writing bad things about Apple. So the higher iPhone 6 figures that started to come through in December were put down to hard core Apple buyers. Yet, those who wrote positively on Apple or contradict the crap that is put out by detractors are demeaned with the "Fanboy" title. Presumably that is meant that those so named are incapable of logical thought on the subject. Have you seen what Android evangelists put out? There are plenty of Mac-dedicated sites that are critical of Apple when necessary, with even MacDaily News complaining at times, while others are noticeably critical of policy in the App Store when developers suddenly have their work rejected. Of late, while others have been enthusing about Photos, I have commented on Aperture: I am not really happy that this is to end development as Photos in its current form is too diluted for those like me or professional photographers. Photos handles my iPhone and iPad pics fine, editing these on the fly; but so much is missing when compared to Aperture and its plugins. This week, I was also concerned when I tried to make a donation to Nepal. There is a Red Cross page in the iTunes Store, but not here. And when I used the link from another site, I was given a point-blank refusal.

I make that the introduction to a rumour that was passed onto me today. Comments on the forums at Phantip (which I have not read), suggest problems with the early Samsung Galaxy S6: loose home button, uneven finish, and poor screen attachment. Normally, such a rumour is not worth much, but only yesterday I read some insightful comments from Rene Ritchie (iMore) on design and the comparative quality of iPhone 6 and the Samsung Galaxy S6.

Although some people prefer Samsung products above those from Apple, it may be for reasons other than design. Or the Android. Or the integration. For some, I know that the main decider in product purchase is Anything but Apple, because as we all know, Apple is always wrong. The Samsung phone I bought so that I could assist my mother in the UK, because she found it so hard to use, gathers dust in my bedroom. Every time I pick it up and turn it on (in itself an effort because of the delays as it comes up to speed), I wonder how people work with these devices and with Android.

The growth was fueled by record second quarter sales of iPhone and Mac and all-time record performance of the App Store.

As well as comments from Tim Cook in the statement, Luca Maestri (CFO), added "The tremendous customer demand for our products and services in the March quarter drove revenue growth of 27 percent and EPS growth of 40 percent. Cash flow from operations was also outstanding at $19.1 billion."

The statement and the announcement are the bones of what happened, but the meat comes when Tim Cook is questioned by the press afterwards. An excellent report of this appeared from Jason Snell (Six Colors) who typed out the main comments after Cook's own preceding statement. My only criticism here is that the names and affiliations of those asking questions were not included.

While many are impressed with the design, some users have experienced problems. Some of these may be down to unfamiliarity. One charging problem for example was because some users omitted to remove the plastic protection. Others, however, will need rectification.

Another comment on supply made me take note: "by sometime in late June, we currently anticipate being in a position that we could begin to sell the Apple Watch in additional countries". This is just what I had expected and I have commented a number of times that I would be surprised to see the device here in Thailand before June or July, except of course in places like Mahboonkrong, although even supply there seems to be limited for this product. When asked about future demand for the Apple Watch, he said,"I'm thrilled with it, Tony. I don't want you to read anything I'm saying any way other than that", so when I read an article om Wall Street Journal with the headline, "Is Tim Cook Sufficiently Excited by Apple Watch?" I wonder which dictionary they were looking at for the definition of "thrilled". Ah, but then I saw that the writer was Daisuke Wakabayashi, a reporter who has been criticised before concerning erroneous reporting on Apple by Daniel Eran Dilger, The Loop and John Gruber among others. I had watched Jim Cramer on TV yesterday evening here. He was in an outside studio overlooking the Bay in San Francisco. It looked cold to me, but he took his coat off after viewer comments. I used to dislike Cramer a few years back as he often seemed to be talking Apple shares down. He changed and discusses the company positively, but objectively now. His predictions (I was watching this about 12 hours before the results were released) were quite close: he expected sales in China to exceed those in the US; and also said that Apple "will post "remarkable" results". For a brief look at some of what some other analysts wrote, Philip Elmer-DeWitt on Fortune has collected some excerpts from their notes. Most are bullish, with one or two, neutral.

As mentioned above, much of this good news came from sales in China where, Alex Wilhelm (TechCrunch) reports, there was "71 percent revenue growth" in the quarter and Apple is thought to have "sold more iPhones there than in the United States." Also interesting is how the revenue in China of $16.8 billion compares to the $12.2 billion for Europe.

Having taken part in a couple of these programs, I am aware that I am one of hundreds (maybe thousands) who are providing feedback and that Apple does examine all the comments, sometimes asking for more information: this can range from user comments up to running additional processes.

A couple of good user experiences have appeared as well. Not simply, I hate the watch, but objective examinations of what problems they are experiencing - it is not just a smaller iPhone - and how they have dealt with the oddities. Of these, I rather like "My rocky first 24hrs with the Apple Watch" by Matt Haughey (Technology Musings) who has some observations that are valid. Also worth looking at is My First Impressions of The Apple Watch by the well-known photographer, Scott Kelby. Number 1 is my favourite: "You do need to read the instructions - it's not an iPad where everything's so obvious."

There are still mysteries concerning the services sectors that Apple is in, beginning with the apps stores and including iCloud. As more users switch to using this to store their photographs taken on more and more iOS devices, so they will need more space. I still think that the jump from 20 GB to 200 GB is too large and will deter many users. For some, the idea of paying for anything they cannot see or hold is anathema. I know someone who owns several expensive cameras as well as Macs and the iPhone. Whenever I suggest an app, the first question is, "Is this free". When I say it is not, he shudders and says, "no". End of subject. With iCloud that aversion will erode slowly, but Apple could build this more effectively by better spacing of storage plans.

Discover, Best Buy, and others. As Jim Dalrymple points out (The Loop) one of the major competitors to Apple Pay was expected to be MCX Consortium (Walmart, et al). As these services grow, so Apple's invisible (and unmeasurable) income will increase. The analysts may be able to make predictions - often wrong - based on component ordering and trends, but the services are hidden from such eyes, so as the figures take on more importance, the ability to predict Apple's performance will be harder; and Apple is less likely to do that shrinking act that so many are wishing would happen. Watching CNBC and listening to comments from analysts, most seem more than happy with Apple's reported results. Projections are pushing the idea that the share price could edge towards $190 before the end of the year (it is currently about $135) and this would value the company at $1.2 trillion. One of those appearing mentioned those hidden services I outline above, but also included the probability of income in some form from HealthKit and from HomeKit.

A number of sources are reporting on comments from the Wall Street Journal who are concerned that Bromwich is charging Apple for reading newspapers, Rene Ritchie (iMore) reports, with a suitably acidic comment. As a note, the WSJ is behind a paywall and while I did see the original article earlier, it is not now accessible to me.

Graham K. Rogers teaches at the Faculty of Engineering, Mahidol University in Thailand where he is also Assistant Dean. He wrote in the Bangkok Post, Database supplement on IT subjects. For the last seven years of Database he wrote a column on Apple and Macs. He is now continuing that in the Bangkok Post supplement, Life. |

|

For further information, e-mail to

Back to

eXtensions

Back to

Home Page