|

|

Sunday Comment: Mixed Quarterly Tech Results; Analysts on Apple - Sell, Buy, Hold; Deaf CompaniesBy Graham K. Rogers

This was followed shortly after by Microsoft who missed the expected diluted net income per share of $2.23 by $0.07. With revenue of $51.87 billion the target was missed by some $490 million: just under 1%. Problems with China may have pushed the numbers down, but Google does not have a presence in China, while Apple relies on manufacturing industries there and has considerable sales in the country. Its sales of iPhones in India also rose this quarter. After the results, shares in Microsoft also rose 4%, perhaps helped by CEO Nadella's comments on the future investment path.

Facebook/Meta also needs user data, but its focus on growth may be causing long term damage, as it did to Uber. Although analysts are concerned about growth and fret when Apple does not show the same growth as others, that has always been the situation: Apple is in this for the long term, not quarter to quarter. Meta released its figures and showed a fall in revenue, which it is blaming on several factors, including Apple and its privacy controls. If that is all it takes to unsettle such a company, maybe the foundations need shoring up. Note that Google is introducing ways that tighten up privacy and the way advertising is delivered (Ivan Mehta, TechCrunch). As Meta has just increased the price of its Oculus devices by around $100 due to more expensive parts, that may also limit how its metaverse system may be able to grow. If users cannot afford the only goggles that work, it will be of limited value. Also posting results were Intel, with a $2.6 billion target miss. Earnings are falling. At the same time Intel is investing much capital into new developments following the release of Apple silicon (and other developments).

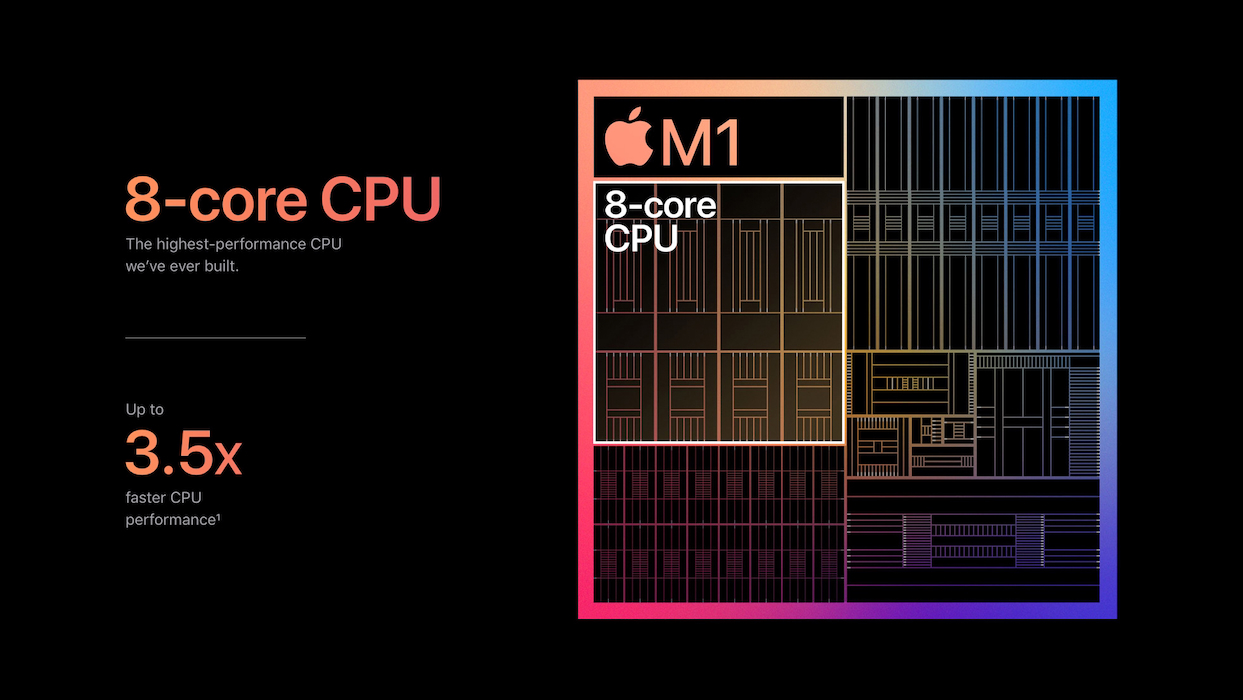

Apple Silicon - Image courtesy of Apple

The Company posted a June quarter revenue record of $83.0 billion, up 2 percent year over year, and quarterly earnings per diluted share of $1.20. "This quarter's record results speak to Apple's constant efforts to innovate, to advance new possibilities, and to enrich the lives of our customers," said Tim Cook, Apple's CEO. "As always, we are leading with our values, and expressing them in everything we build, from new features that are designed to protect user privacy and security, to tools that will enhance accessibility, part of our longstanding commitment to create products for everyone."

On Six Colors, Jason Snell has done us all a service by making a transcript of the conference call available in which Tim Cook and Luca Maestri (CFO) make statements, followed by questions from the press.

Looking at a number of analysts' comments I could not help noticing that the advice given, depending on which article I read, was that investors should either buy Apple stock, or hold, or sell. One from three: you cannot go wrong. Note that the richest investors hold lots of Apple stock. Investment funds make short time gambles. For months, analysts have been warning about sagging iPhone sales in China, but with the $40.67 billion figure it is reported that sales of iPhones in China have increased (Mike Peterson, AppleInsider). Do these analysts find their numbers in dumpster trucks?

During the announcements concerning Meta's quarterly figures, which were considerably lower, Zuckerberg commented on the different philosophy that the company had specifically with regard to Apple and the Internet (Ed Hardy, Cult of Mac). Z also told us that FaceBook will be adding even more recommended (or unwanted) content from users that are not followed (Pesala Bandara, PetaPixel). It is apparently 15% now and will rise to around 30%. Zuckerberg said, "As our AI finds additional content that people find interesting, that increases engagement and the quality of our feeds". Just like Uber: growth at any cost. If you keep doing the same thing and the situation does not improve, maybe a change is needed. They are not listening. I am not sorry I dropped Facebook. I am now considering closing my Instagram account. However, late in the week, and after Z had announced the increased content delivery, Adam Mosseri of Instagram has said, Instagram will "walk back some recent changes to the app that have led to intense criticism from users" and "will also temporarily reduce the number of recommended posts that users see" (Aisha Malik, TechCrunch). Note that "temporarily" - they hope this will go away. Like King Lear, and some more recent world leaders, Z invents his own reality. There is an interesting side note to this with regard to companies that are deaf to their users' comments or complaints; and Apple is not perfect here. The "prolix and relentless" political columnist, George Monbiot's mother died last year, but the family found it impossible to close the Vodaphone account. Monbiot's column on this is a study in frustration. When he expressed this on his Twitter feed, he was surprised by the number of other people who had similarly suffered the same problem. The bills keep coming. If the family of the deceased fail to pay them, debt recovery companies are brought in and members of the family could find that their credit rating is affected. Monbiot went full attack in the Guardian and that eventually brought a sort of non-committal apology. He is waiting for a meeting with the top management. Commenting on this, Rob Beschizza (Boing-Boing) suggests that Vodaphone will never change as "The likely outcome is some pointless years-long wrangle over trivial aspects of customer service policy implementation, because burning down the corporate and legal context that enables all this is unthinkable." Ergo, Facebook, Instagram, Meta et al.

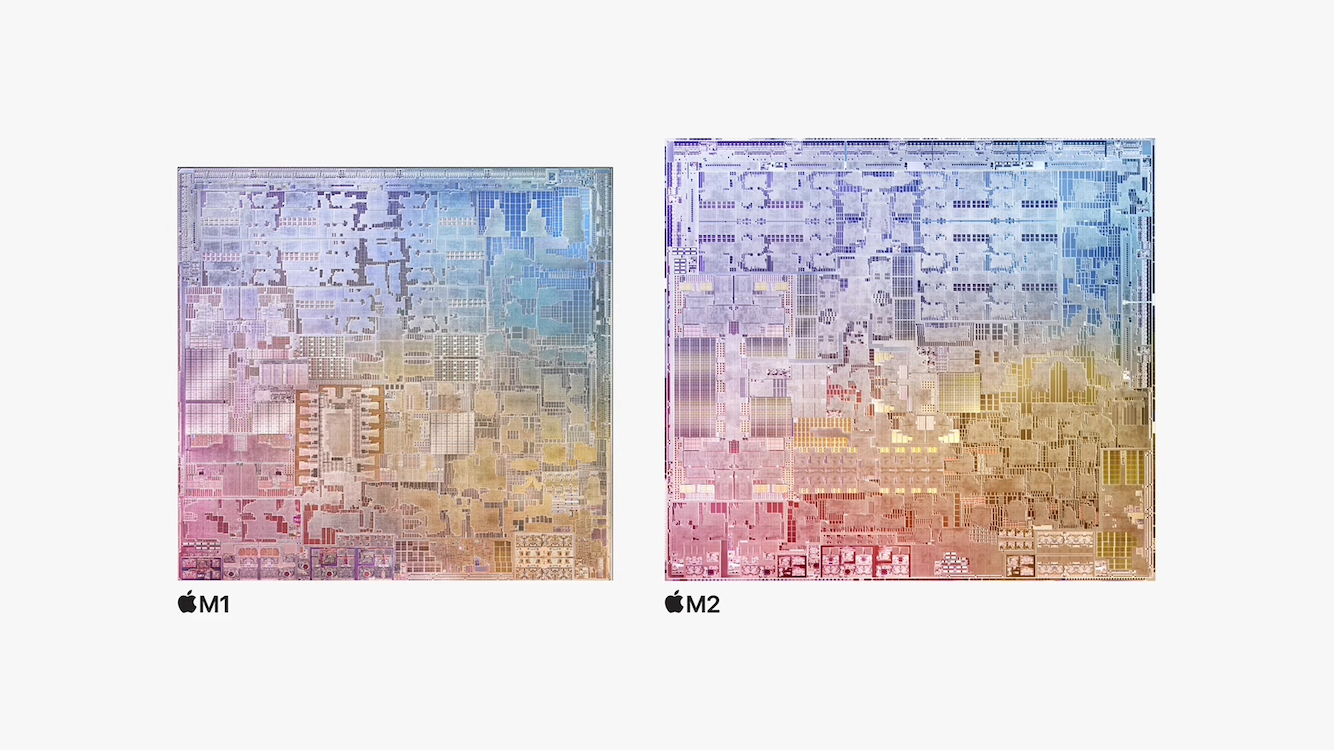

Apple MacBook Air with M2 chip - Image courtesy of Apple

All other models have been updated to Apple silicon except this top device. The Intel-equipped Mac Pro is still on sale (basic price in Thailand is 189,000 baht), but with performance that cannot match the Apple Studio, unless maxed out at some cost (1,456,000 baht). Mark Gurman suggests that there was a Mac Pro in the pipeline last year, but that Apple held it back, waiting for the M2 (Sami Fathi, MacRumors), which sounds sensible, but also allows them to offer a better range of options from a super M2 Extreme (whatever they call it) down to the M1 Ultra and Pro. A report from Oliver Haslam (iMore) suggested that the M2 chip to be used (I think there will be several options), could have "up to 128 GPU cores and 40 CPU cores".

M1 and M2 chips - Image courtesy of Apple

Graham K. Rogers teaches at the Faculty of Engineering, Mahidol University in Thailand. He wrote in the Bangkok Post, Database supplement on IT subjects. For the last seven years of Database he wrote a column on Apple and Macs. After 3 years writing a column in the Life supplement, he is now no longer associated with the Bangkok Post. He can be followed on Twitter (@extensions_th) |

|

Financial analysts look at the data they have, which is not the same as that available (in Apple's case) to CFO, Luca Maestri, and they speculate on what they think the figures for the quarter, should be. Some analysts are spectacularly wrong, time and time again (both high and low), yet the companies are still assessed by Wall Street on how they compared to expectations. This week, it was reported that Google's diluted net income per share of $1.21 missed expectations by $0.06 and on $66.69 billion revenue missed by $110 million. These are rounding errors. That figure showed growth of some 16% year over year. The shares rose some 4% as the view is that this is not too bad under current conditions.

Financial analysts look at the data they have, which is not the same as that available (in Apple's case) to CFO, Luca Maestri, and they speculate on what they think the figures for the quarter, should be. Some analysts are spectacularly wrong, time and time again (both high and low), yet the companies are still assessed by Wall Street on how they compared to expectations. This week, it was reported that Google's diluted net income per share of $1.21 missed expectations by $0.06 and on $66.69 billion revenue missed by $110 million. These are rounding errors. That figure showed growth of some 16% year over year. The shares rose some 4% as the view is that this is not too bad under current conditions.

Although I enjoy looking at Reels on Instagram, my main purpose has always been to share photographs. Changes in the last years made it less easy to see as many photographs as the video content increased. Recently it was announced that this would change and more such content would be made available, increasing the amount of content from those that users were not following: getting in the way because Meta knows best. This brought out a lot of negative comments from users, including some famous names, while

Although I enjoy looking at Reels on Instagram, my main purpose has always been to share photographs. Changes in the last years made it less easy to see as many photographs as the video content increased. Recently it was announced that this would change and more such content would be made available, increasing the amount of content from those that users were not following: getting in the way because Meta knows best. This brought out a lot of negative comments from users, including some famous names, while