|

|

Cassandra - Midweek Review: Analysts and Apple on Q3 2019; Ilford emulates Willy WonkaBy Graham K. Rogers

Nope. None of that, so if you are still reading the stuff that Wall Street analysts put out, you might be better off buying some chickens and examining the entrails for all the accuracy that might give. To make sure we are being politically correct, please do not kill any chickens, read the output of writers who understand Apple and dump those analysts: they are costing investors money. According to Ben Lovejoy (9to5 Mac) Wall Street analysts were actually prepared to believe Apple's own guidance this time and were not making any rash predictions that Apple could fail to live up to. Apple predicted that it expected to produce revenue somewhere between $52.5 billion and $54.5 billion, which is not bad (some companies would kill for this), but this could still mean lower overall revenue for the year. There is less excitement about the next iPhone this year we were told (it is an annual event and after 12 years some analysts have grown blasé). No matter, Tim told us all. Maybe he really does know what is happening at Apple. I looked at a couple of early reports from Seeking Alpha concerning the Q3 2019 figures as factually the information is reliable. Brandy Betts tells us that revenue is up 2.8% , with a breakdown showing the average of analysts' predictions:

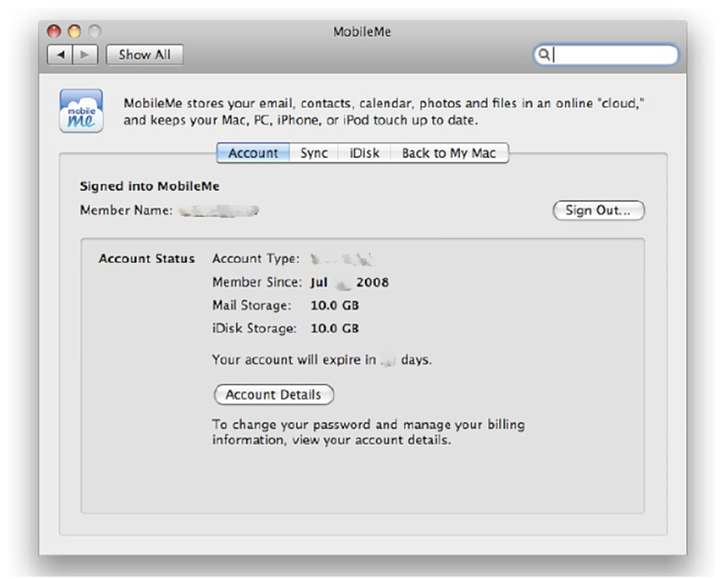

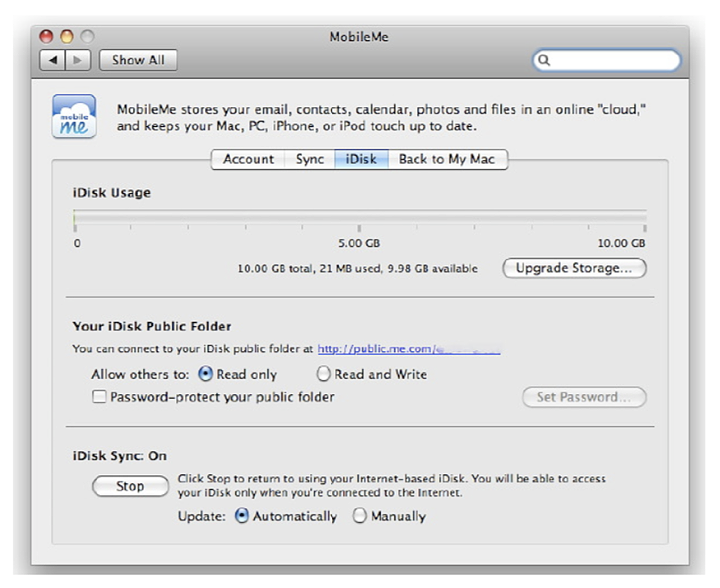

The iPhone and iPad were fractionally lower, with Macs selling marginally better, while wearables, which includes the Apple Watch were higher as was the figure for Services which continues to grow and is now a major generator of income, as I predicted back in the days when iCloud was called .Mac (it was iTools first, then MobileMe), with the user base this could only grow. My use has grown from the free 5GB up to a 1TB subscription because of the synchronization of data (especially photographs) between my Macs and iOS devices and as a backup service. I am not alone; but to iCloud I can also add Apple Music, so monthly I pay Apple a fair amount. Multiply that by millions of users worldwide and this is always going to be an area that will grow. We also note that "Greater China revenue was $9.2B, down from $9.5B in last year's quarter" which is nowhere near the disasters that had been predicted, following a general fall in sales for all smartphone makers and the current trade disputes between the USA and China. Apple's own Q3 2019 press release is headed, "Company Revenue Sets June Quarter Record" which is clear enough. Guidance for Q4 2019 is $61-64B (consensus: $60.9B); and I note that is slightly up on last year's guidance: predicting revenue of between $60 billion and $62 billion so Apple is not doomed just yet, but let's see what damage the analysts can do between now and October.

Ah. . . Apple Pay, one of the dreams for those of us in Thailand, along with the Home Pod, a fully-functioning Siri and perhaps the Apple Card. At least there is now a real Apple Store in Bangkok, where real Apple people are at work.

Mobile Me Preferences

Ilford have taken the idea and refined it. As it is a manufacturer of black and white films, Harman Technology are to use silver tickets, but there will only be two, so the chances of finding these will be lower than winning the lottery (or a tour of the chocolate factory). The films that may contain the tickets (all marked with a red 140 sticker (after 140 years of production) are HP5+ 135 24, HP5+ 135 36, FP4+ 135 36, DELTA PROFESSIONAL 3200 135 36, DELTA PROFESSIONAL 400 135 36, DELTA PROFESSIONAL 100 135 36, XP2 SUPER 135 36, DELTA PROFESSIONAL 3200 120, DELTA PROFESSIONAL 400 120, DELTA PROFESSIONAL 100 120, HP5+ 120, FP4+ 120 . I note that my favourites: SFX and PanF Plus are not included, but I can make do with some FP4 Plus. There are also a couple on that list that I really ought to hunt down.

Ilford Medium Format Film

For some reason, Cole Rise (Petapixel) decided to make a replica of the Hasselblad Moon camera, because there are so few available: 16 were left on the moon and they are not really accessible. The task is detailed in his text, and includes several problems he encountered. One of these concerned lubricants as the vacuum of space creates special conditions that make normal lubricants unusable. In the article there is a link to a PDF on the NASA site which outlines the problems investigated and solutions that were devised. The NASA article is a superb example of clarity in writing: the engineers who produced this put their ideas over in a simple and direct form that many academic engineers are incapable of. Obfuscation is the way for them; writing in the most complex way and with words which mask the meaning. You see what I did there?

Earthrise - image courtesy of Hasselblad

Tamron 35mm f/1.4 lens

Graham K. Rogers teaches at the Faculty of Engineering, Mahidol University in Thailand. He wrote in the Bangkok Post, Database supplement on IT subjects. For the last seven years of Database he wrote a column on Apple and Macs. After 3 years writing a column in the Life supplement, he is now no longer associated with the Bangkok Post. He can be followed on Twitter (@extensions_th) |

|