|

|

eXtensions - The Wednesday File (68): Apple Q3 2018 Results, Exquisite Timing, Rumours and Fallout; Extortion by PhishingBy Graham K. Rogers

Apple today announced financial results for its fiscal 2018 third quarter ended June 30, 2018. The Company posted quarterly revenue of $53.3 billion, an increase of 17 percent from the year-ago quarter, and quarterly earnings per diluted share of $2.34, up 40 percent. International sales accounted for 60 percent of the quarter’s revenue.

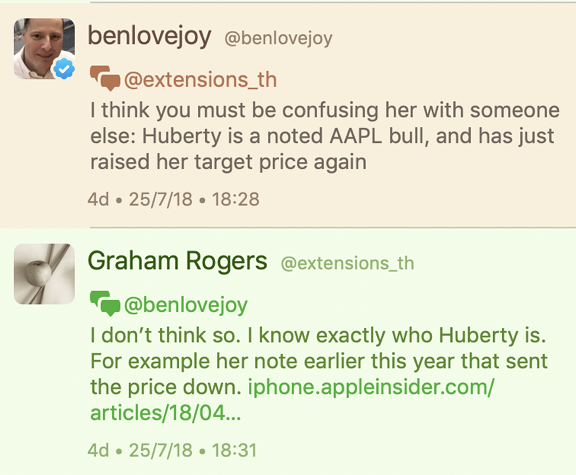

I followed that with "I am still waiting for the "well-connected Apple analyst" Ming-Chi Kuo then Toni Sacconaghi [to make comments]. We could follow that with Gene Munster, the always negative Michael Blair and maybe even a guest appearance by Trip Chowdhry. Read their "sell" advice, and buy." In my notes I commented that, although almost everyone suggests that Ming-Chi Kuo is almost infallible, a search shows that it appears he is far from perfect. I also noted that (Mark) Gurman has a good record on device predictions although has tailed off now he is with Bloomberg who seem to have their own Apple agenda. That Tweet could not be sent as the original could not be found so I sent another, but then saw I had been blocked. Well, if that is all it takes.

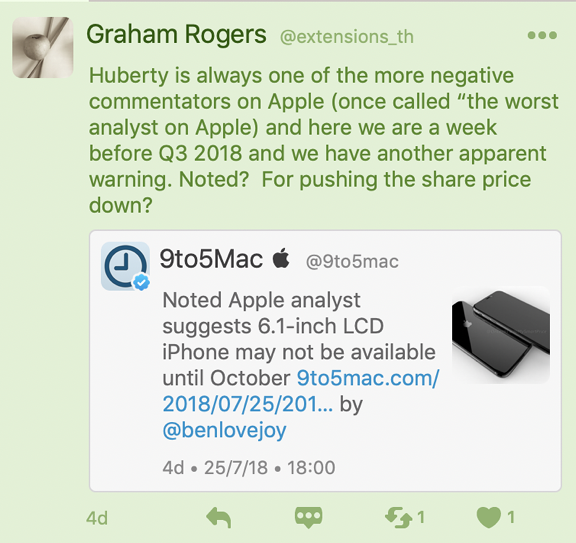

Perhaps The Macalope is missing some deep, quantum-mechanical subtext in Huberty's notes, but she has an odd habit of predicting problems for Apple's next quarter during the week leading up to the company releasing its financials. And that was my point, and (I guess) what got me blocked. OK, for the Macalope, but not for me. Tae Kim on CNBC also had Huberty's contradictory recommendations of poor figures, but time to buy when the stock falls: it falls because analysts make such recommendations, and always just before the results are put out. Huberty is reported to say that the figures will be in line with expectations, but this is not rocket science: they always are. I cannot remember a time when Apple missed its own targets, although there were plenty of times that the share prices were hit because Apple failed to meet analysts' over-confident guesstimates. Only once did Apple exceed its guidance (2009) and then, in compliance with SEC rules, it made a filing explaining why the figures would be exceeded: "new accounting principles significantly change how the Company accounts for certain revenue arrangements that include both hardware and software elements".

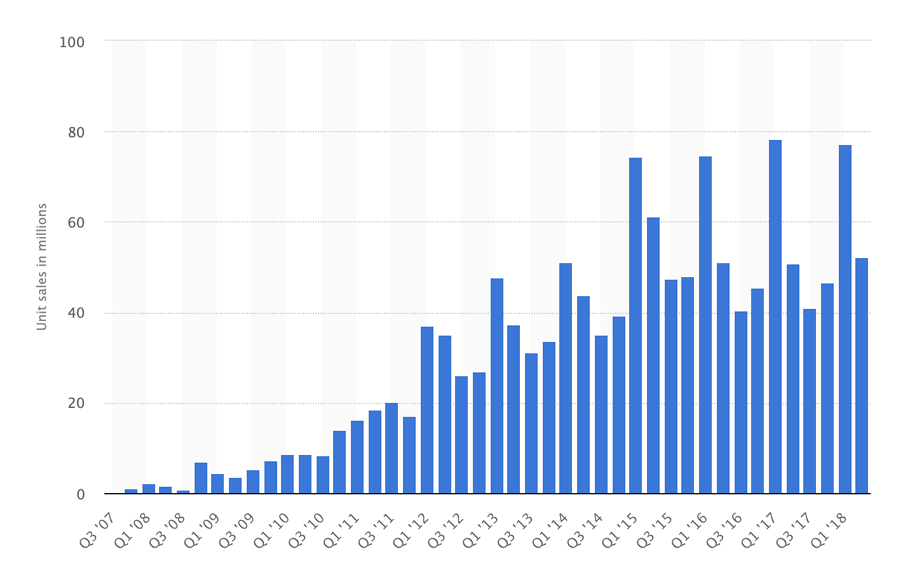

Global Apple iPhone sales from 3rd quarter 2007 to 2nd quarter 2018 (in million units): Source, Statista

So what else did we see: CNET suggests that "2018 iPhone speeds could lag behind Android, and the new LCD iPhone might be delayed - CNET"; I also read that the iPhone 9 (9?) was delayed on one site so did a Google search and also found that the next iPhone X (the one that some had earlier reported was to cease production) was also expected to be delayed. Apart from a series of sites that I did not recognise, the main contender here was Forbes (Ewan Spence), a publication not noted as a torch carrier for Apple. The alleged problems seem to center on supply chain reports about the screens for the new model (or models). We have been warned about supply chain before, as recently as the iPhone X which everyone was predicting to be a total disaster, until it wasn't. There was also a report from Canalys suggesting that although the Apple Watch had seen quite good sales, it was losing market share. Not that sales were falling, but a hint of negativity just before the Quarterly report does wonders (Isobel Asher Hamilton, Business Insider). In my run through of news on Wednesday morning before putting this online, I saw that The Macalope had also written an item on this item. I must be on the right track. As I mentioned, these were all in the week just before Apple's Q3 financial report, when in the couple of months before all had been rosy. On the other hand, Bill Maurer (Seeking Alpha) is expecting new highs: if not now, in the coming quarters. This was a sensible analysis, looking at upcoming releases and some possible negatives: a balance on the possibilities and probabilities for the near future in Apple land. As a note, Catherine Shu (TechCrunch) reports on Samsung's Q2 2018 results which were not so good after Galaxy S9 sales were lower than expected. China is the problem there with so many low-end handsets. Perhaps better to build a product that doesn't clone others' successes, without resorting to gimmicks like the proposed folding screen phones they are said to be working on. Like fingerprint technology and FaceID, copying the idea does not always lead to a good product if the underlying technology details are not properly worked out.

As my original AirPods went back to the company that had generously let me hang on to them for over a year since the Bangkok Post column ended, I had to buy my own. This was always going to be the first purchase I made as I have come to rely on these and love using them. I have noticed that battery life is much better. With the old ones, just before they went back I was experiencing a couple of hours use before a quick charge (about 10 minutes) was needed. This week, with the new ones I had 4 hours before they needed a boost. Earlier this week, it was reported by several sources that new beta versions of iOS 12 and macOS Mojave were released. There are still a couple of months to go before the final versions are made available, so this lengthy testing should find most of the problems. As was made evident last week, even the testing before the release of a new MacBook Pro could miss something. One user found processor throttling in some working conditions. Apple contacted the user immediately, tested the conditions outlined and had to release a supplementary update to 10.13.6. Apparently the new Macs are now sailing along.

But Qualcomm is also having troubles of its own. It was after acquiring Dutch chipmaker, NXP, for $38 billion, because China failed to provide approval for the deal in time. That alone has cost Qualcomm $2 billion in a termination fee (Klint Finley, Wired). This is less to do with Apple and more to do with the tit-for-tat that is going on between China and the USA on the question of trade.

The value of Facebook fell some $120billion (around 20%) after its earnings report with poor user growth and missed expectations (Max A. Cherney, MarketWatch). A lot of people have been walking away after the Cambridge Analytica problems and what that is still revealing; while European subscribers have declined significantly after the introduction of GDPR, although COO Sheryl Sandberg said that the GDPR has not affected the company's top line. Part of the dissatisfaction was with the attitude of (and weak answers from) Mark Zuckerberg, whose own fortune took a massive hit last week. Local users here are also reporting that they are unsubbing. Imagine if Apple dropped 20%, the world would end for many in Wall Street; but Facebook, Twitter? Meh. . . .

However, in Japan where there were devastating floods recently, it is reported that Apple is footing the bill for devices damaged by the floods: any iPhones, Macs, iPads, and iPods (Benjamin Mayo, 9to5 Mac). I remember also that when the courts in Texas forced Apple to compensate those who had been charged for repairs when sensors that had probably been affected by humidity indicated water damage, none of that was made available to the many users in Thailand. They had also been denied warranty repairs and had to pay, when humidity was perhaps the cause that the sensors turned pink. Japan, OK; Texas, OK. Thailand? Fix it yourselves.

Why, oh why did Apple not keep supporting this. It still works (see the flooding pic, above), but the files from my Nikon D850 are not recognised, so for the time being, I am still using Apple Photos. This is OK up to a point as I can get round organisation problems, synchronise the images across iCloud and edit quite well within the application with the help of app extensions (themselves idiosyncratic) and that is both the problem and the solution. There is also shockingly poor metadata availability. Using Capture One gives me an awkward workflow as I still want to use Photos and the 2 TB of iCloud space I have, while relying on Capture One would need a couple of disks and I want this all to be mobile. Part of my final decision on the application will depend on how it all works with the XQD card reader that is being shipped from the USA right now. Like so many devices here, the necessary support and spares are rarely available for those who buy devices. I could buy the expensive camera but had to hunt around for an XQD card (the shop I bought the camera from still does not have these); and no one here has a card reader. I have reported on examples such as micro-USB to USB-Cables and HomeKit devices. Although computers with USB-C ports have been available here for over 3 years, and external disks with micro-USB ports are most common here, the cables are nowhere to be found. I bought a couple from Amazon and this made a huge difference to how I am able to work (also with the new camera). Those cables are from Belkin whose products are widely available here: just not those particular cables. HomeKit products have begun to appear - and this is really slow - with Philips Hue lighting kits arriving only in the last couple of months. A look on the shelves this week showed that a few more devices are now trickling through, but the retailers are painfully slow at this.

As the blackmail in the message wanted me to send $1000 to a Bitcoin address, I contacted someone in Bangkok who I know has knowledge in this area. I know nothing about crypto-currencies. It was suggested that as well as changing passwords, I put some of the text in a Google search window and see what comes up. Quite a lot actually as the same scam has been around for a while and was even featured in the British Daily Mirror. I began to feel much better. One of the links in that reassuring article was to a detailed analysis by security writer Brian Krebs. My Google search had also brought up a link to My Online Security which had a link to have i been pwned?, which is connected to 1Password; and this had been recommended by my local contact who told me that this sends up a warning when an account is compromised. I entered the specific email address and up came three sites that had been compromised: Adobe (thus justifying my distrust of the convoluted logins there); MySpace; and in an Anti Public Combo List, which was a hacked list, so might have come from anywhere. I had not used the specific password for a long time. The main content of the phishing email was as follows, so if you see something like this, ignore it. Or if you are in the USA, contact the FBI.

in fact, I put in place a viruses over the adult videos (adult) web site and guess what happens, you visited this website to have fun (you know very well what What i'm saying is). While you were watching videos, your internet browser began operating like a RDP (Remote Desktop) which provided me accessibility of your screen and web camera. and then, my computer software obtained all of your current contacts from the Messenger, Microsoft outlook, Facebook, as well as emails.

What did I really do?

I made a double-screen video. Very first part shows the recording you are seeing (you have a good taste haha . . .), and Second part shows the recording of your webcam.

There was no video with the email, I use no Microsoft applications, and I had certainly never logged in to a porn site.

Well, I think, $1000 is really a fair price for your little secret. You'll make the payment by Bitcoin (if you do not know this, search "how to purchase bitcoin" search engines like google).

Bitcoin Address: 14zQaCN6bCno4nHLYmmfFZxxKd5DE6AZNZ

(It is case sensitive, so copy and paste it)

Important:

You've got one day to make the payment. (I've a unique pixel within this e-mail, and at this moment I am aware that you've read through this email message). If I do not get the BitCoins, I will certainly send your video recording to all of your contacts including family members, coworkers, and so on. Having said that, if I receive the payment, I'll destroy the recording immidiately. If you need evidence, reply with "Yes!" and i'll definitely send your videos to your 6 contacts. It is a non-negotiable offer, that being said don't waste my personal time and yours by answering this message.

. . . and I certainly don't have $1,000 spare. I would decline anyway with such awful grammar.

Graham K. Rogers teaches at the Faculty of Engineering, Mahidol University in Thailand. He wrote in the Bangkok Post, Database supplement on IT subjects. For the last seven years of Database he wrote a column on Apple and Macs. After 3 years writing a column in the Life supplement, he is now no longer associated with the Bangkok Post. He can be followed on Twitter (@extensions_th) |

|

To go with this, a rumour last week, (

To go with this, a rumour last week, ( I am still undecided about finally buying or subscribing to Capture One 11, which I continue to use. A problem for me as a non-professional photographer who makes full use of iCloud and synchronisation between my Macs and iOS devices, is that Capture One can do so much. It is like Word for Windows that has so many features available - many of which only a few may use - that most could make do with a text editor. Aperture was set out like Capture One (there were certainly similarities with Capture One 8), but it looked like Apple engineers had sorted through and selected the best tools and features for the user.

I am still undecided about finally buying or subscribing to Capture One 11, which I continue to use. A problem for me as a non-professional photographer who makes full use of iCloud and synchronisation between my Macs and iOS devices, is that Capture One can do so much. It is like Word for Windows that has so many features available - many of which only a few may use - that most could make do with a text editor. Aperture was set out like Capture One (there were certainly similarities with Capture One 8), but it looked like Apple engineers had sorted through and selected the best tools and features for the user.