Cassandra: VAT Rule Changes - Easing Open the Door for Taxation of Online Transactions

AMITIAE - Sunday 8 December 2013

|

Cassandra: VAT Rule Changes - Easing Open the Door for Taxation of Online Transactions |

|

|

|

By Graham K. Rogers

Under the law (Article 86/4 of the Rassada Legislation), clients of the company must provide details of a tax identification number. The changes in the law are intended to tighten up the fraud that occurs with issue of VAT invoices and there is a small amount of useful information about this on the Mazars website which provides information and advice about doing business in Thailand. The Revenue Department also has some information on VAT, although the page was last updated in June this year.

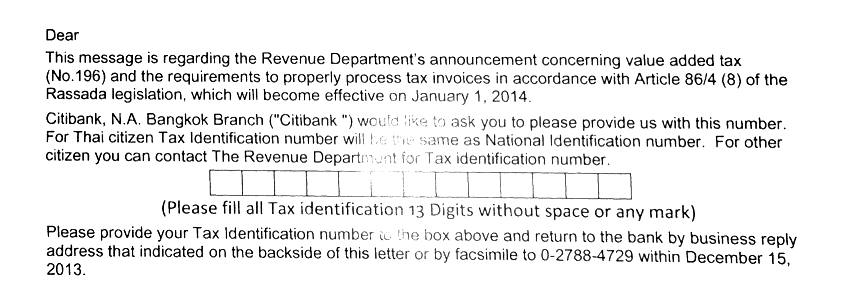

Part of the English Language Section of the Citibank Letter on VAT

It should also be noted that, as reported in the Bangkok Post on 4 November, the "government is considering imposing value added tax (VAT) and income tax on mobile application transactions.

Graham K. Rogers teaches at the Faculty of Engineering, Mahidol University in Thailand where he is also Assistant Dean. He wrote in the Bangkok Post, Database supplement on IT subjects. For the last seven years of Database he wrote a column on Apple and Macs. |

|

For further information, e-mail to

|

|